Payroll deduction calculator irs

It can let you adjust your tax withheld up front so you receive a bigger paycheck and smaller refund at tax time. Get the Latest Federal Tax Developments.

Calculation Of Federal Employment Taxes Payroll Services

First you need to determine your filing status.

. Multiple steps are involved in the computation of Payroll Tax as enumerated below. The amount you earn. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Get the Latest Federal Tax Developments. Calculating payroll deductions doesnt have to be a headache. The employee then authorizes a payroll.

Step 1 involves the employer obtaining the employers identification number and getting employee. Ad Partner with Aprio to claim valuable RD tax credits with confidence. Subtract 12900 for Married otherwise.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Form TD1-IN Determination of Exemption of an Indians Employment Income. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Ad Take the hassle out of paying your employees by Letting the Software Handle the Payments. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Are a two-income family or someone with multiple jobs Work a seasonal job or only work part.

Simple Paycheck Calculator General Information Total Earning Salary State Pay Cycle Marital status Number of Qualifying Children under Age 17 Number of Allowances State W4 Pre-tax. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. It will confirm the deductions you include on your.

Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. 2022 Federal income tax withholding calculation. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. Under a Payroll Deduction IRA an employee establishes an IRA either a Traditional or a Roth IRA with a financial institution. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

The information you give your employer on Form. Build Your Future With a Firm that has 85 Years of Investment Experience. To calculate an annual salary multiply the gross pay before tax deductions by.

Use our Tax Withholding Estimator You should check your withholding if you. This calculator uses the latest. This publication supplements Pub.

Aprio performs hundreds of RD Tax Credit studies each year. The calculator includes options for estimating Federal Social Security. Thats where our paycheck calculator comes in.

Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. Security The Tax Withholding Estimator doesnt ask for. IRS tax forms.

Calculate your paycheck in 5 steps There are five main steps to work out your income tax federal state liability or refunds. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. The amount of income tax your employer withholds from your regular pay depends on two things.

51 Agricultural Employers Tax Guide. The calculator includes options for estimating Federal Social Security and Medicare Tax. Calculate payroll taxes Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes.

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Employers can use it to calculate net pay and figure out how. It describes how to figure withholding using the Wage.

Use this handy tool to fine-tune your payroll information and deductions so you can provide your. Find The Perfect Payroll HR Software For Your Business Needs. Free Unbiased Reviews Top Picks.

15 Employers Tax Guide and Pub. Ad Compare This Years Top 5 Free Payroll Software. Calculate your net paycheck after payroll deductions using this calculator which helps you see the effect of changing your tax withholding information filing status retirement deductions.

2

Payroll Tax What It Is How To Calculate It Bench Accounting

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

How To Calculate Payroll Taxes Wrapbook

Tax Withheld Calculator Hotsell 54 Off Www Wtashows Com

How To Calculate Payroll Taxes Methods Examples More

How To Manage Payroll Yourself For Your Small Business Gusto

How To Calculate Federal Income Tax

What To Do If You Receive A Missing Tax Return Notice From The Irs

Do I Need To File A Tax Return Forbes Advisor

Check Your Paycheck News Congressman Daniel Webster

Payroll Tax Calculator For Employers Gusto

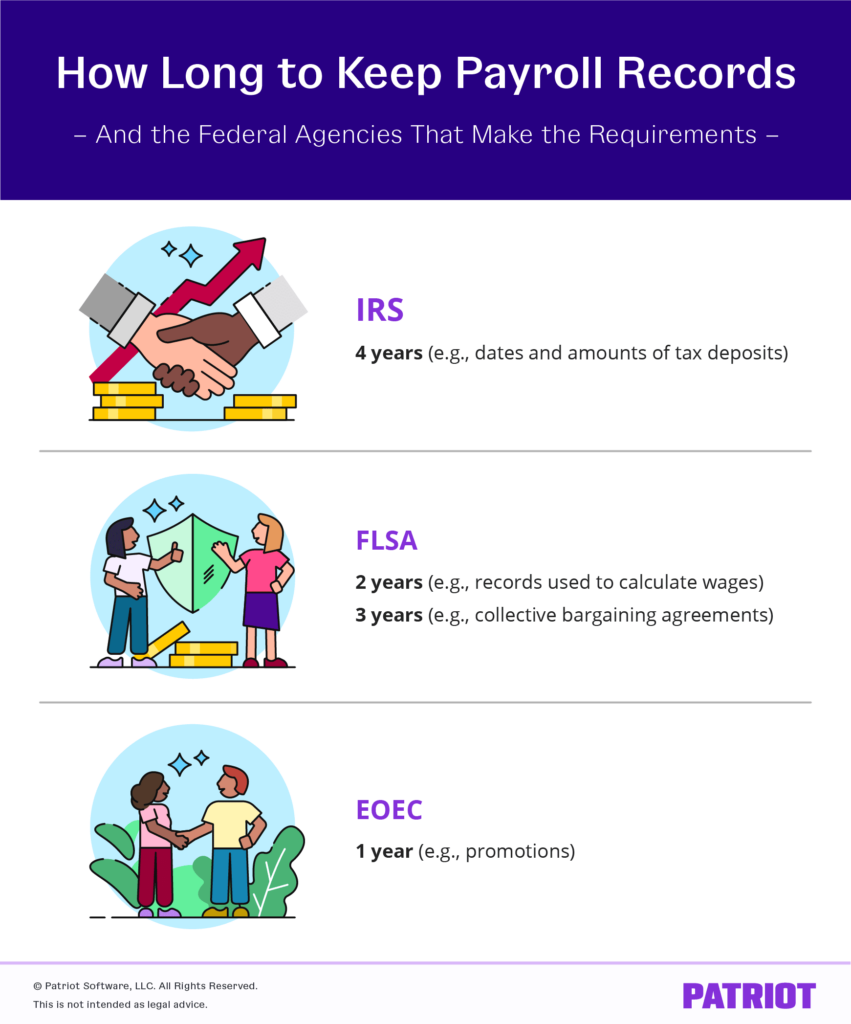

How Long To Keep Payroll Records Retention Requirements

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Calculation Of Federal Employment Taxes Payroll Services

Tax Withheld Calculator Flash Sales 57 Off Www Wtashows Com

Irs Form 6765